Ekiti State has topped the chart for improved Internally Generated Revenue (IGR) among the 36 states of the Federation, according to a recent report.

The Joint Tax Board (JTB) released the findings during its 155th meeting at Zuma Rock Resort in Suleja, Niger State.

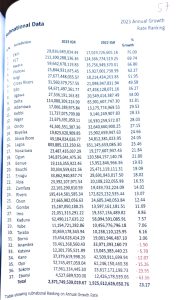

The report highlights that Ekiti State ranked first in the 2023 Annual Growth Rate Ranking, with its IGR increasing from ₦17.03 billion in 2022 to ₦29.82 billion in 2023.

This remarkable 75 percent growth rate is attributed to enhanced reporting and significant growth in IGR by the state.

Ekiti State has also made significant strides in other rankings. It moved up to 16th position in the Total Collections Ranking, a notable improvement from its previous position among the worst five. Additionally, under the Direct Assessment Parameters, the state improved from 33rd to 15th position.

In terms of specific tax categories, Ekiti State ranked 25th in Withholding Tax collections and 28th in MDA collections. The Chairman of Ekiti State Internal Revenue Service, Mr. Olanitan Olatona, expressed optimism that all MDAs would continue to enhance their collections and reporting to further improve future statistics.

Mr. Olatona noted that the state government has not introduced any new taxes. Instead, it has effectively deployed technology to block leakages and streamline the payment process.

This technological advancement, coupled with prudent spending by the government, has deepened citizens’ confidence.

The state’s focus on infrastructure, human capital development, healthcare delivery, and economic opportunities has encouraged taxpayers to fulfill their obligations on time, while also anticipating more benefits from the government.

The IRS chairman also mentioned that the state government plans to include more citizens in the tax net through various empowerment programs and job creation efforts.